What is a Private Limited Company?

A Private Limited Company is a company registered under the Companies Act, 2013. They have limited liability for its members and is privately held. This means that its shares cannot be traded publicly. Just like all corporate entities, they are also governed by the Ministry of Corporate Affairs. This type of business structure allows businesses to grow and at the same time not involve themselves with the complexity and compliance of a public company.

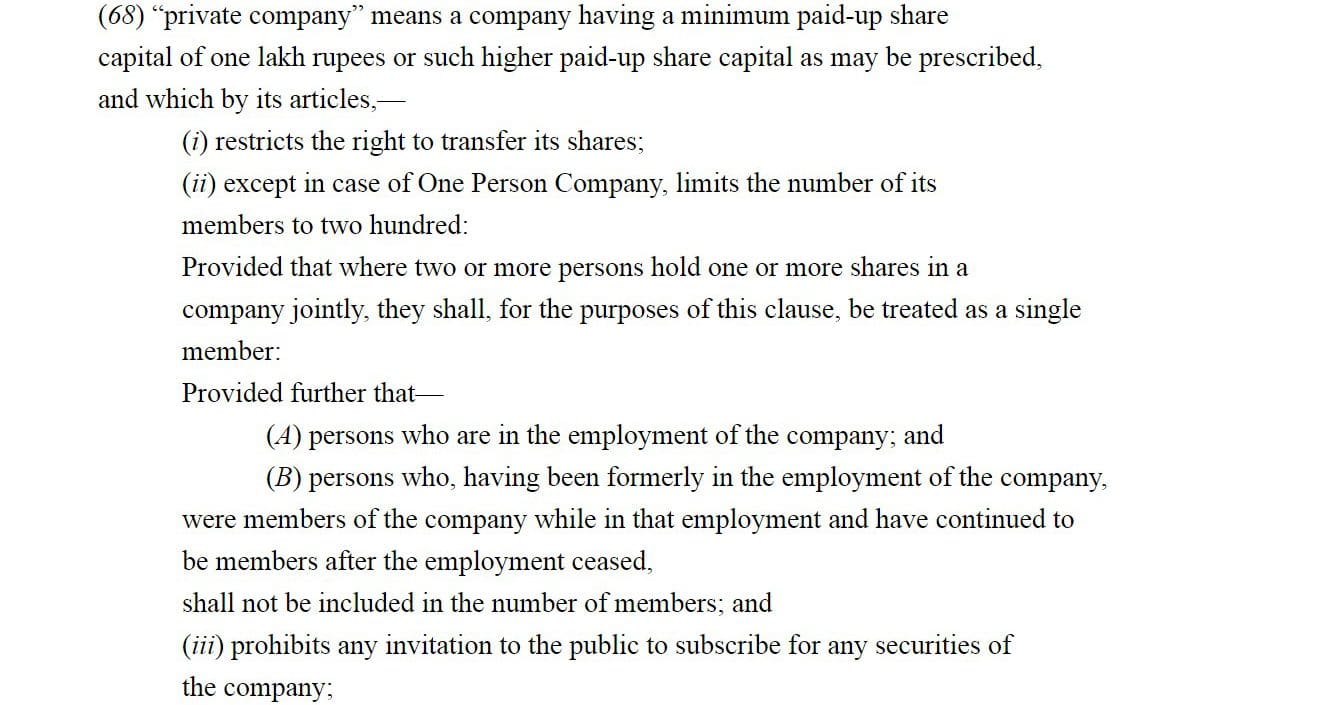

Companies Act, 2013 (with regard to a Private Limited Company)

Section 2 (68) of the Companies Act, 2013 states-

It is important to note that this this definition of a private company has since been amended (in the year 2015). Following the amendment, the minimum paid-up share capital requirement was removed.

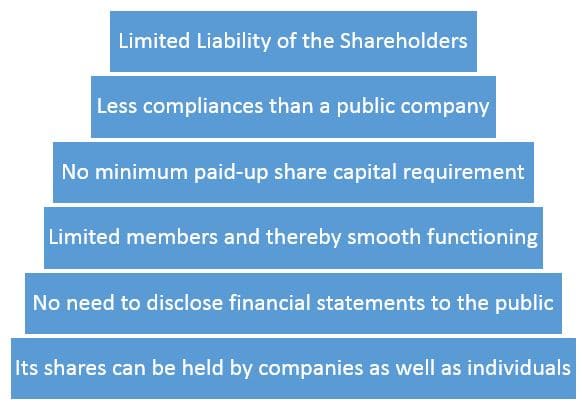

Advantages of a Private Limited Company

- It can raise more capital owing to the fact that there are more members involved. Secondly, corporate entities like Venture Capital Firms or Angel Investors, etc. can be members of a private company. This implies that they can hold shares also.

- The shareholders of the company have limited liability. They are liable to pay only the unpaid value of the share they own. If the company goes bankrupt and defaults on the payments of its creditors, the personal assets of the members cannot be used to meet the deficit.

- It does not need to issue prospectus. Since it does not invite the public to subscribe to its shares, i.e., it cannot raise capital from the public

- It has to comply with less legal formalities and compliances as compared to public limited company.

- There is no minimum paid-up share capital requirement for a Private Limited Company to commence its business.

- Unlike an OPC, it has the option to recruit more members as well as directors and make use of their managerial or operational expertise.

Due to the fact that a Private Limited Company has limited members, the management is comparatively smoother and easy.

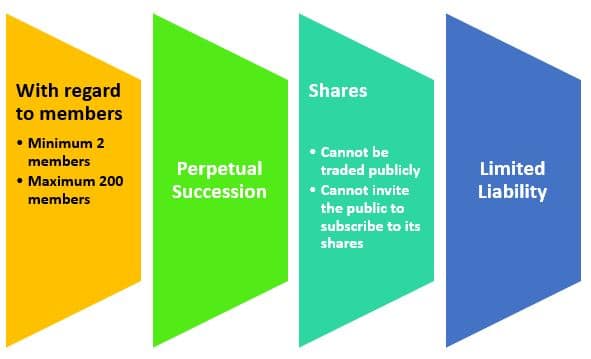

Characteristics of a Private Limited Company

With Regard to members-

- It needs a minimum of 2 members at the time of incorporation

- It can have a maximum of 200 members. This number cannot be exceeded at any point of time

Perpetual Succession-

- It is not impacted by the insolvency, death or bankruptcy of its members. Since it is a legal entity, it keeps on existing.

Liability-

- The maximum liability of the shareholders is the unpaid amount of face value of the shares they own. In case of insolvency, the personal assets of the members cannot be used meet the company’s debts.

Shares-

- Its shares cannot be transferred without the consent of the other members, subject to Articles of Company.

- Its shares cannot be traded publicly or on stock exchanges. The company will have to turn public if it wants its shares to be traded publicly.

- The company cannot invite the public to subscribe to its shares

Nomenclature-

- The name of every private limited company are followed by the words Private Limited. The words are shortened and written as Pvt. Ltd.

How to register a Private Limited Company?

To register a Private Limited Company, the following steps have to be followed:

- Form SPICE PART A –

After the reforms of the year 2020, the name of a company can be reserved prior to everything by filling out a Form SPICE PART A.

- DSC–

Procure Digital Signature Certificate (DSC) of all the shareholders and the directors.

- SPICe PART B–

To incorporate the company a Simplified Proforma for Incorporating Company Electronically (SPICe) form has to be filled out. At this stage, the documents of the directors and shareholders are submitted. This form also helps procure Director’s Identification Number (DIN) of all the proposed directors. The form needs to be attested and certified by a Practicing CS/CA/CMA/Advocate.

- MoA and AoA –It is prepared by a professional in consultation with Promoter/members/Directors.

MoA is the Memorandum of Association. It is filed with the registrar of companies for incorporating it. MoA is the foundation of the company. It defines the powers of the company and its scope.

AoA is Articles of Association. It describes the management of the company, the duties and responsibilities of its directors, internal management etc.

- Certificate of Incorporation, PAN and TAN– E-Copy of Certificate, PAN and TAN is provided to newly incorporated companies by MCA.

Note that earlier the registration process was different. In the year 2015 following the celebration of the 69th Republic Day, the government put into effect a simpler procedure for incorporation. Prior to those changes, Inc-1 was filled for company name and DIN had to be obtained in a different manner.

Requirements of Registration

The following documents are required at the time of the company’s incorporation:

For all Directors and shareholders:

- PAN Card

- Identity Proof

(Aadhaar Card, Driving License, Passport, Electricity/ Telephone Bill, Ration Card, Voter Identity Card)

- Proof of Residence

(Bank Statement, Electricity/ Telephone Bill/ Postpaid mobile bill)

- Passport Size Photo

- Email and mobile number

Foreign Nationals who are members of the company need to furnish different documents for identity proof.

A Company or any Artificial Legal Entity that is a member needs to furnish different documents as well.

For Registered Office Address Proof:

If the Office Premises are rented, then-

- Copy of lease deed or rent agreement

- The Electricity bill / Gas bill / Postpaid mobile or telephone bill along with NOC from Owner of premises.

- Address and Identity proof and PAN card of the Landlord

If the Office Premises are owned, then-

- Official papers of the property

- Utility bill (telephone, gas, electricity, etc.)

- No Objection Certificate

- Sale/Property deed

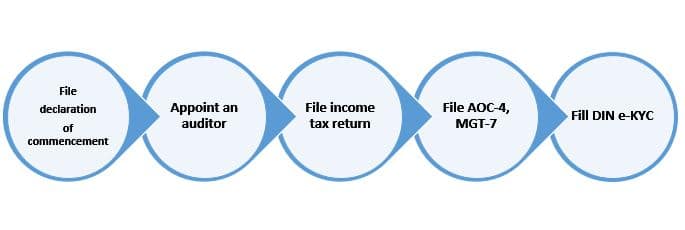

Compliance following registration

A private limited company has to comply with the following after incorporation-

- File a Declaration of Commencement – within 180 days of incorporation. It is a very important document. Failure to file this document within the stipulated time can have unfavorable consequences for the company.

- Appoint an auditor.

The company has to appoint an auditor within 30 days of incorporation. The auditor should hold the office until the first annual general meeting concludes. If the board cannot appoint an auditor, it has to inform its shareholders about it.

- File income tax return-annually (Form ITR6).

- File AOC4 – For Annual Financial Statements.

Within 30 days of its Annual General Meeting, the form AOC-4 has to be filled for filing the financial statements.

- File MGT-7 – For Filing Annual Returns. It has to be filed for registering the annual returns.

- Fill DIN e-KYC– KYC documents every year along with OTP verification of mobile number and email.

Conclusion

A Private Limited Company is a very efficient structure for startups and other young & growing businesses. It helps to separate the entity from the owners and at the same time adds professionalism to their business. Incorporating a Private Limited Company may be a bit of a hassle. To reduce that hassle and help you with incorporating your very own private limited company, reach out to us at Registration Arena.